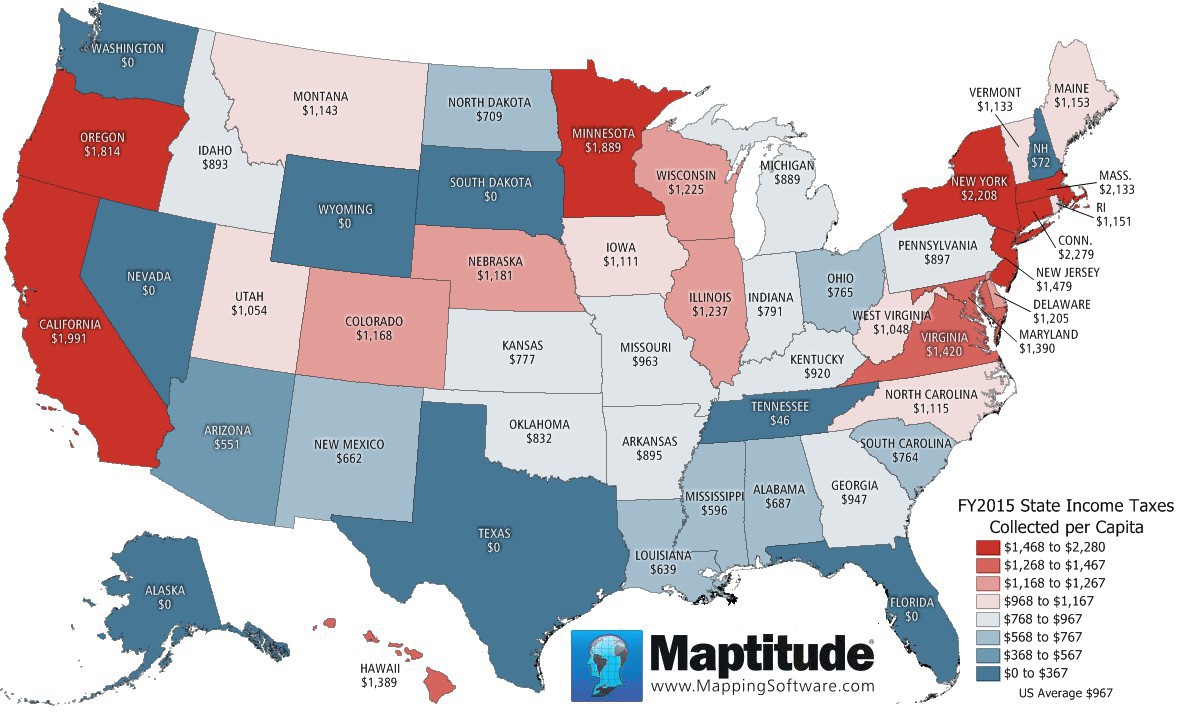

Maptitude is the best mapping software for business intelligence! Individual income taxes are the single largest source of state tax revenue in the United States. This is despite nine states having no tax on wage or salary income (Alaska, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming). On average, Americans paid $967 in state income taxes in 2015. The five states with the highest taxes paid were: Connecticut ($2,279), New York ($2,208), Massachusetts ($2,133), California ($1,991), and Minnesota ($1,889). See how your state compares to the national average in the map below.

If you need a custom map for your story, blog, or website, contact us because we offer a limited number of free custom maps on a first-come, first-served basis! See our Featured Maps for inspiration.

Map: Created with Maptitude Mapping Software by

Caliper, April 2017

Source: Tax Foundation

Home | Products | Contact | Secure Store