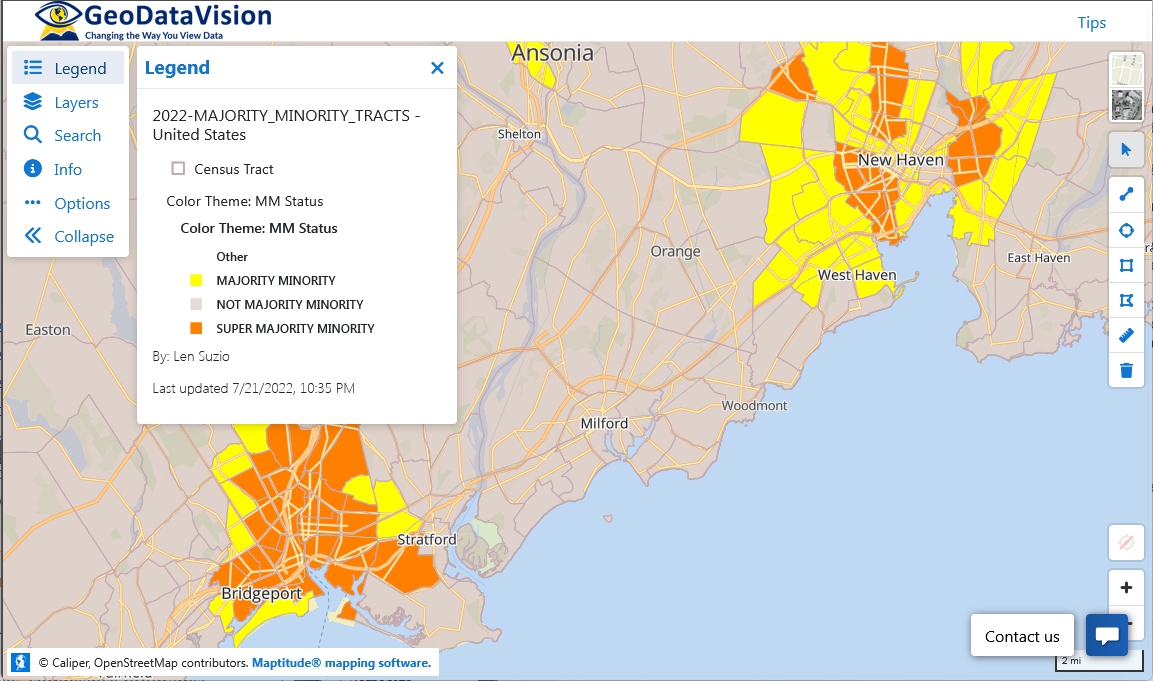

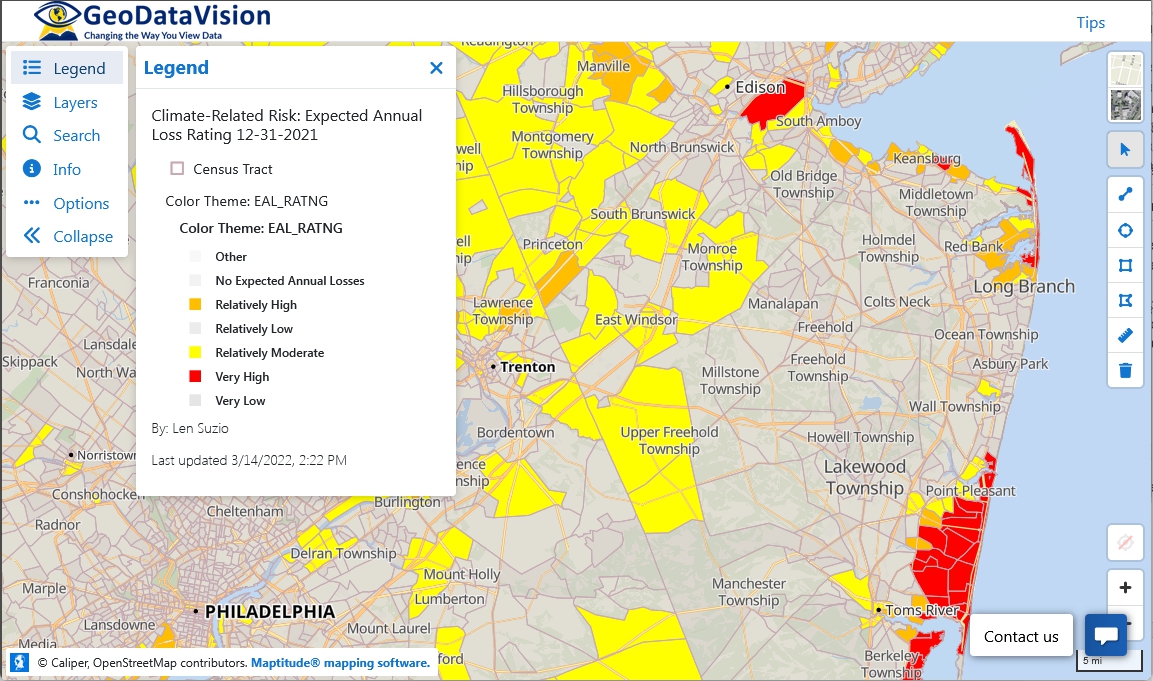

GeoDataVision, a banking compliance consulting firm based in Connecticut, helps financial institutions map and analyze their Community Reinvestment Act (CRA) assessment areas and fair lending data. As the firm's client base grew to hundreds of banks nationwide, it needed a more efficient way to integrate disparate demographic and lending datasets and to visualize risk exposure across different communities. GeoDataVision turned to Caliper Corporation's Maptitude GIS software to simplify this process. Over the past two decades, they have created maps for 600–700 banks using Maptitude, leveraging its powerful built-in data and analysis tools to identify underserved areas and compliance gaps. By adopting Maptitude Online for cloud-based map sharing, GeoDataVision can now collaboratively publish interactive maps for clients and regulators, making it much easier to assess and demonstrate compliance in real time. This GIS-driven approach has streamlined regulatory analysis and even impressed bank examiners with the clarity of GeoDataVision's maps.

Banks are required by law to serve the credit needs of all communities where they operate, including low- and moderate-income and majority-minority neighborhoods. For GeoDataVision's clients, this meant delineating CRA assessment areas accurately and analyzing a wealth of data (branch locations, loan records, Census demographics, competitor presence) to identify any underserved or high-risk areas. Traditionally, assembling these maps and reports was labor-intensive and cumbersome, often involving multiple software tools or static maps that were hard to update. GeoDataVision faced the challenge of making this process both comprehensive and efficient. They needed to integrate regulatory datasets (such as FFIEC Census tract data) with mapping in one place, and to do so in a way that could be easily understood by bank executives and examiners. Additionally, as GeoDataVision began serving hundreds of banks across the country, sharing the resulting maps and analyses with clients and regulators became a logistical challenge. The firm required a solution that would allow collaboration and real-time access to maps, so that both bank teams and regulators could view and interact with the latest compliance insights without cumbersome coordination.

Caliper Corporation provided Maptitude as the one-stop GIS solution for GeoDataVision's needs. Maptitude allowed GeoDataVision to unify all relevant location-based data and produce clear, actionable maps for compliance. In particular, Maptitude enabled GeoDataVision to achieve several key objectives:

“We've used Maptitude for more than 20 years and have created maps for 600–700 banks with Maptitude. We are very enthusiastic about Maptitude Online...we have gotten a tremendous response. We've found that even bank regulators are visiting our online maps!”

Len Suzio

President,

GeoDataVision

By implementing Maptitude, GeoDataVision significantly streamlined its compliance mapping workflow. What once required piecing together data from various sources now happens within one GIS environment, saving time and reducing errors. The firm has efficiently produced maps and analyses for hundreds of banks without needing a large technical staff: a testament to Maptitude mapping software's ease of use and automation features. Complex analyses, such as evaluating each branch's practical service area using drive-time polygons, can be done in minutes. Notably, when GeoDataVision began using drive-time rings to define branch service areas, "the regulators were really impressed," according to GeoDataVision's president, Len Suzio. The maps clearly demonstrated how far each branch reaches and whether any populated areas were left outside those reach, providing regulators with a new level of insight into the bank's coverage.

Another major benefit has been improved communication and transparency. The interactive maps shared via Maptitude Online have enabled a new level of engagement. Bank management and compliance officers can now visually confirm that their CRA assessment areas include all the required neighborhoods, and they can quickly identify any outliers or anomalies in lending patterns. GeoDataVision reports that the response to these online maps has been overwhelmingly positive, in Len Suzio's words, "tremendous." Clients appreciate the ability to drill down into their own data geographically, and regulators appreciate the easy access to up-to-date maps showing compliance metrics. In fact, some examiners proactively consult GeoDataVision's published maps during their reviews, a strong indication of trust in the information being presented.

Ultimately, Maptitude has helped GeoDataVision's client banks proactively meet their CRA and fair lending obligations. By readily identifying underserved tracts or potential compliance issues on the map, banks can address these areas before they become findings in an exam. The GIS-based approach also adds credibility to the banks' compliance programs: presenting examiners with detailed, data-backed maps demonstrates a high level of diligence and transparency. This not only facilitates smoother exams but also helps banks direct their community outreach and lending efforts more effectively (for example, by pinpointing neighborhoods that would benefit from increased marketing or a new branch). For GeoDataVision, the ability to deliver such insights at scale has reinforced its reputation as an industry leader in compliance consulting.

GeoDataVision is a U.S. consulting firm specializing in community banking compliance, particularly CRA and fair lending. Based in Connecticut, GeoDataVision has over two decades of experience helping community banks nationwide understand and fulfill their CRA, HMDA, and Fair Lending requirements. The firm's services include CRA assessment area mapping and evaluation, fair lending risk analysis, regulatory performance benchmarking, and compliance training. GeoDataVision has worked with hundreds of financial institutions, crafting maps and reports that illuminate how well a bank is serving each segment of its community. Led by President Len Suzio, a former banker and noted CRA expert, the GeoDataVision team combines regulatory expertise with advanced mapping techniques to provide actionable insights. By publishing interactive compliance maps and offering subscription-based access to up-to-date CRA/Fair Lending data visuals, GeoDataVision has become a go-to resource for banks aiming to excel in regulatory compliance.

GeoDataVision utilizes Caliper Corporation's Maptitude Mapping Software (Desktop and Online) to power its compliance mapping solutions. The firm chose Maptitude for its comprehensive location intelligence capabilities, rich data content, and ease of use. Maptitude comes out-of-the-box with a broad range of socio-economic and geographic data relevant to banking: including the latest Census boundaries, demographics, and Federal Financial Institutions Examination Council (FFIEC) Census Tract data required for CRA/HMDA analyses. This meant GeoDataVision could immediately map key metrics like income classification or minority population percentage without having to procure and import external datasets. According to Len Suzio, Maptitude is "the best bang for the buck" in GIS software, given “the amount of demographic data that comes with the product” and its powerful yet user-friendly features.

By using Maptitude, GeoDataVision can perform advanced analyses such as drive-time calculations, thematic heat maps, and spatial queries with minimal hassle, an important factor for a small team handling large projects. The introduction of Maptitude Online further enhances the technology stack by enabling secure cloud-based sharing and embedding of maps. Now, after performing analysis in the desktop application, GeoDataVision can upload maps to the cloud, where clients and regulators interact with them through a web browser. This flexibility of having both a desktop GIS and an online mapping platform under one system is a unique advantage of Maptitude.

Another reason GeoDataVision continues to rely on Maptitude is its affordability. Maptitude is a cost-effective solution: a subscription license for the full desktop software is priced at US$795, or $1095 with no recurring fees, making it markedly less expensive than many other GIS or mapping tools on the market. Yet, despite its low cost, Maptitude does not compromise on functionality or data: it delivers a professional-grade GIS experience that includes everything GeoDataVision needs for compliance mapping. This combination of robust capabilities, built-in data, and low total cost has made Maptitude an ideal technology partner for GeoDataVision as it continues to innovate in the banking compliance space.

Home | Products | Contact | Secure Store