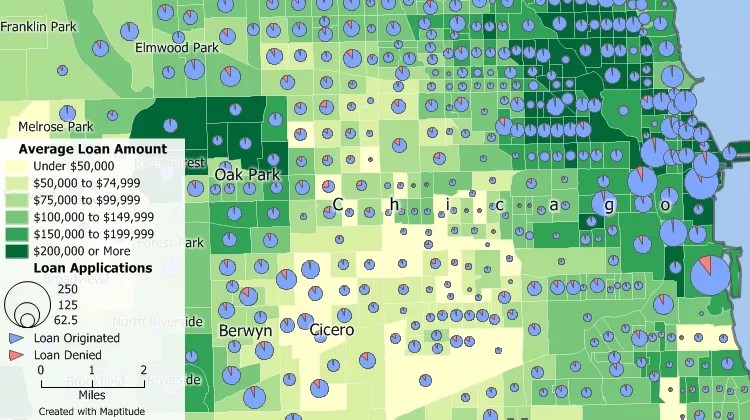

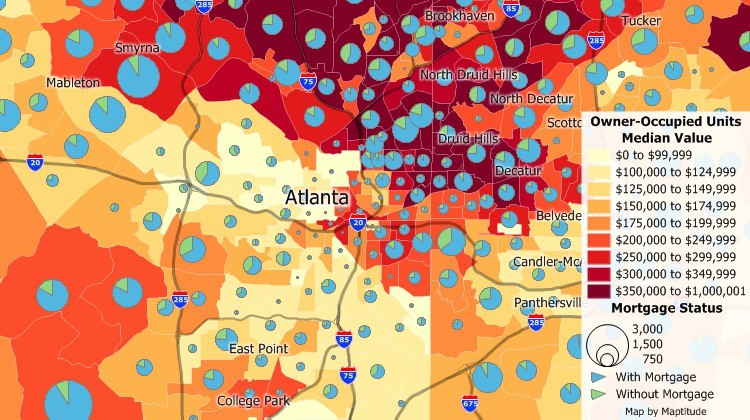

GIS is critical in enabling banks to comply with government requirements such as the Home Mortgage Disclosure Act (HMDA). You can use your own lending data with Maptitude to create Community Reinvestment Act (CRA) maps that verify HMDA compliance and non-discriminatory lending practices.

Maptitude includes the Federal Financial Institutions Examination Council (FFIEC) Census Tract demographics to support the consumer compliance examination process. The FFIEC Census data are required for compliance under HMDA, CRA, and fair lending.

In addition to the extensive Census data supplied with Maptitude (including the latest Census Tracts), there are several additional datasets available from Caliper. These include:

In addition, Caliper offers HMDA datasets that contain records for all the loan applications processed by every financial institution required to file by HMDA. These data are available for every year from 1990 thus allowing time series analysis, and are also available as a geographic layer aggregated by Census Tract.

How Digital Finance Analytics Assesses Financial Stress with Maptitude |

HMDA Wiz Map Alternative: Map loans and assess compliance with Maptitude

Wolters Kluwer Wiz Replacement: Map home values and mortgages with Maptitude

|

“When we are helping financial institutions create and define geographically targeted market segments, HMDA and CRA Small Business analysis, loan trends, Competitive Analysis, market share, Business and Deposit trends - our tool of choice is Maptitude. It is one of the most affordable and feature-packed desktop GIS software in the market. It comes bundled with all the Census and other spatial data related to the financial service industry.”

|

|

“We've been using Maptitude for more than 20 years. It is by far 'the best bang for the buck' in GIS software. I can't believe the amount of demographic data that comes with the product. The sophistication is incredible, but the software is relatively simple to use. We've been using Maptitude to map our CRA Assessment Areas for banks. We also use it for branch impact studies (required by regulators). When we started using drive-time rings to determine the practical service area of bank branches the regulators were really impressed.”

|

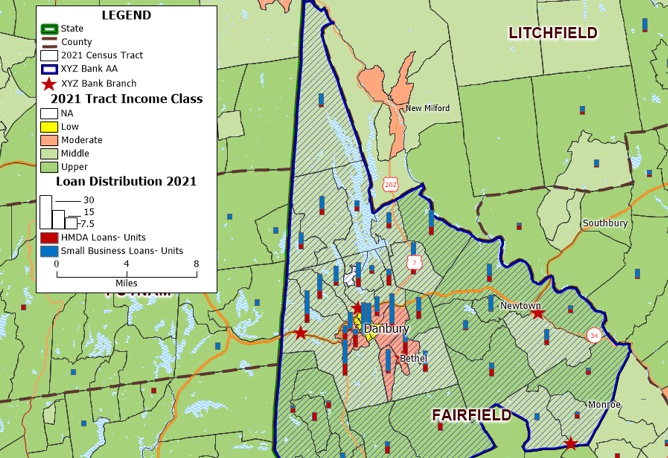

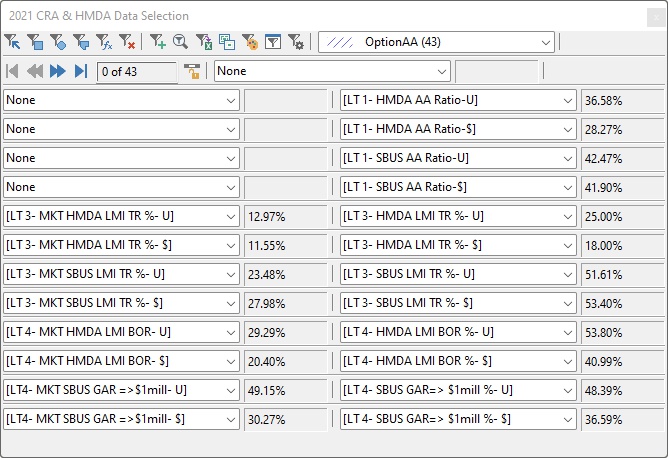

Income and loan distributions within for a bank with its market area highlighed created with CRA Wiz alternative

Maptitude CRA Wiz replacement updates the running totals of a bank's compliance measures when they add areas outside their current market area

Maptitude |

There are many benefits when you use Maptitude as an alternative to HMDA Wiz Map:√ Maptitude is the easiest-to-use full featured mapping software, and includes powerful tools such as multi-ring drive-time zones √ Maptitude has no subscription fees and supports secure off-line data storage

√ Maptitude provides fully customizable maps with unlimited point icons √ Maptitude has unlimited pin-mapping/geocoding √ Maptitude has a full suite of mapping tools √ Maptitude includes free mapping data and demographics covering everything from population statistics to business locations, postal/ZIP Codes, and more! |

Maptitude Demo |

Check out our G2 Reviews

Check out our G2 ReviewsHome | Products | Contact | Secure Store